So there is an uproar of GST ,GST ,,GST..,… all around since few months. Let’s understand what is GST first?

For a Layman GST is “A single comprehensive tax levied on goods and services consumed in an economy”

Few interesting things you would like to know about GST

- The concept of GST appeared first time in India , in 2006-2007 Union Budget speech.

- Concept of GST was first devised by a German economist during 18th Century.

- This is levied at every stage of the production-distribution chain.

-

It is also known as Harmonized Sales Tax.

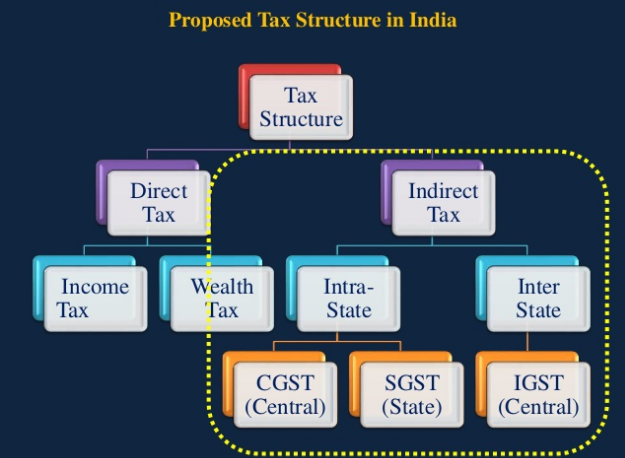

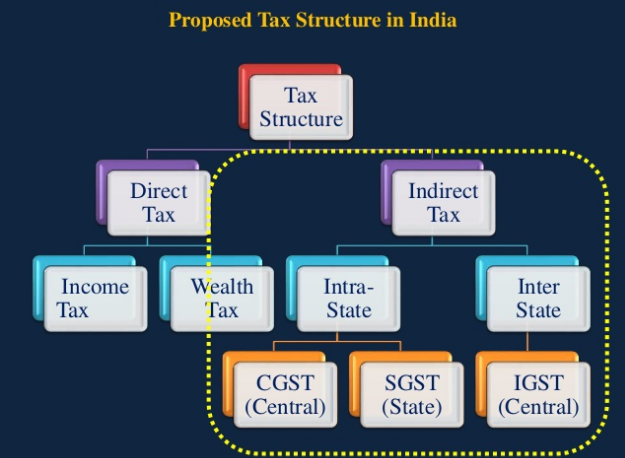

A snapshot of the Proposed Tax structure in India.

Impact of GST on Agricultural Sector.

GST is essential to improve the transparency, reliability, timeline of supply chain mechanism. A better supply chain mechanism would ensure the reduction in wastage and cost for the farmers/retailers. GST would also help in reducing the cost of heavy machinery required for producing agricultural commodities. Under the model GST law, dairy farming, poultry farming, and stock breeding are kept out of the definition of agriculture. Therefore these will be taxable under the GST.

- An agriculturist, for the purpose of agriculture, is not required to register under GST but A better supply chain mechanism would ensure the reduction in wastage and cost for the farmers/retailers.

- GST would also help in reducing the cost of heavy machinery required for producing agricultural commodities.

- Under the model GST law, dairy farming, poultry farming, and stock breeding are kept out of the definition of agriculture. Therefore these will be taxable under the GST.

- The main impact that GST in agriculture would bring is the inflation with currently 4% VAT being increased to 8% on many food items including cereals and grains as the exemption under VAT is limited to unprocessed food. The most affected from the inflation would be the consumers living below the poverty line.

- India’s milk production in 2015-16 was 160.35 million ton, increased from 146.31mt in 2014-15.Currently, only 2% VAT is charged on milk and certain milk products but once GST is implemented with an expected rate of 12%, there is going to be a hike on the price of Milk. Tea is probably one of the most crucial items in an Indian household. The price of tea might also increase due to increase in GST rate from the current VAT rate of 5-6% with Assam and west Bengal with the exception of 0.5 and 1%.

For your reference we have chapter-wise-rate-wise-gst-schedule

GST Council Meeting In Kashmir To Finalise Tax Rates was held on 18th May. Here’s the Schedule. ( Resource- Whats app group) . Note this is not the final list , this may change.

Download the chapter-wise-gate-wise-GST schedule format:DF format : Download the pdf

To Conclude.An increase in the cost of few agricultural products is anticipated due to the rise in inflation index for a small period. Though, implementation of GST is going to benefit a lot, the farmers/ distributors in the long run as there will a single unified national agriculture market. GST would ensure that farmers in India who contribute the most to GDP, will be able to sell their produce for the best available price.